This is a braindump of highlights as I go through the report. It’s a work-in-process and will continue to grow, shrink, evolve as I continue reading.

Notes

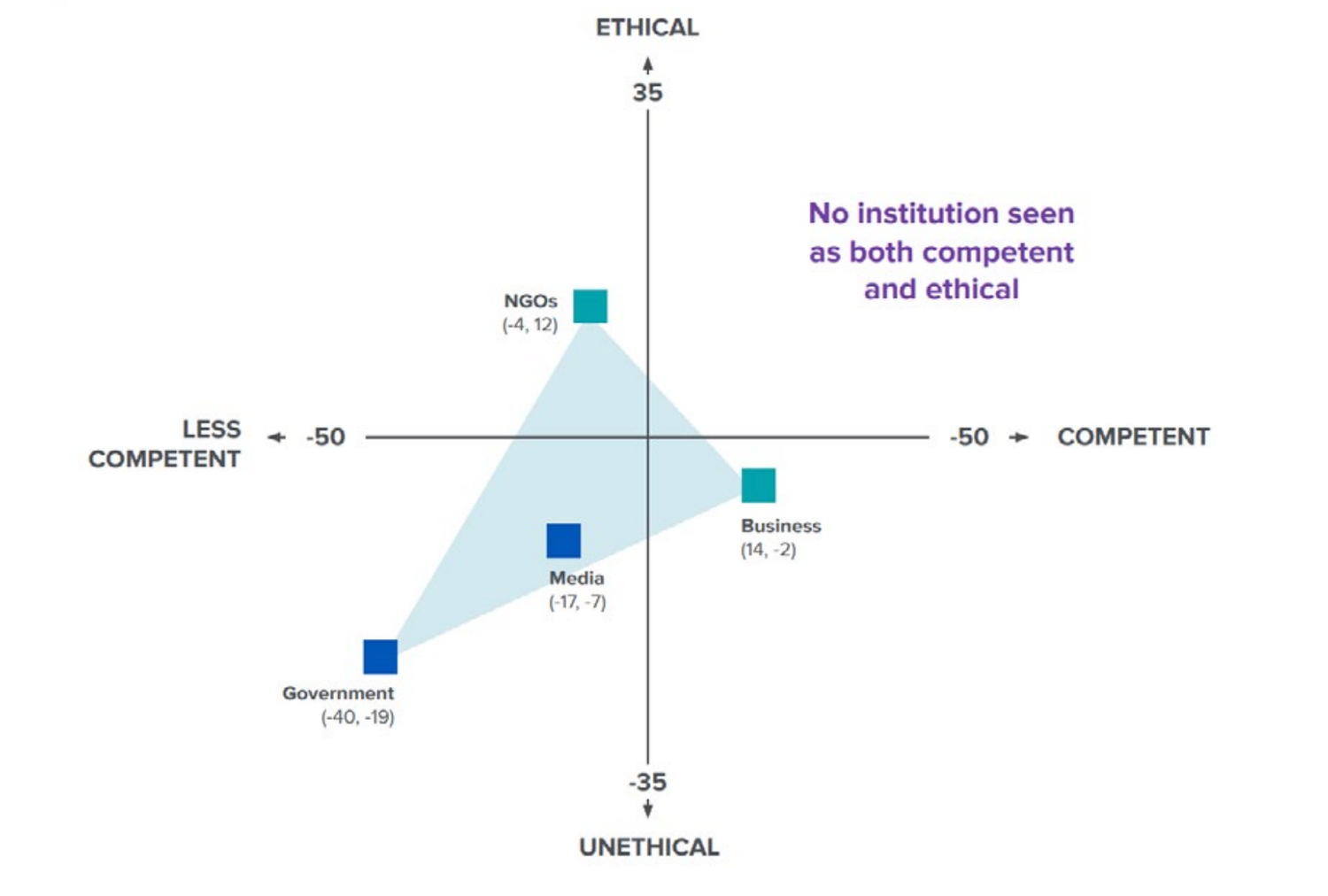

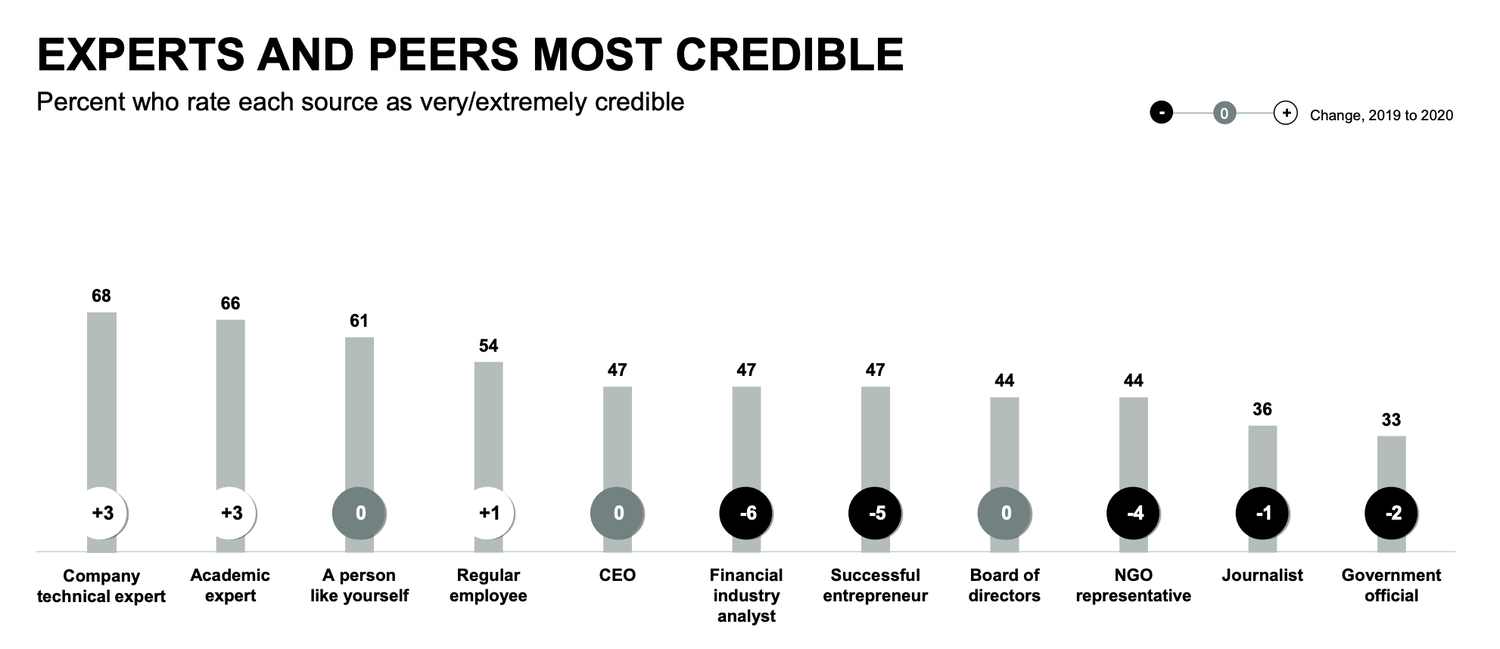

Trust and Faith in Institutions is Declining. None of the four societal institutions that the study measures—government, business, NGOs and media—is trusted.

- Trust is measured by: competence (delivering on promises) and ethical behavior (doing the right thing and working to improve society).

- Distrust is defined as growing sense of inequity and unfairness in the system.

Ethical drivers such as integrity, dependability and purpose drive 76 percent of the trust capital of business, while competence accounts for only 24 percent.

NGOs seen as Purpose driven, Honest, Has Vision, is Fair

'digital authoritarianism and big tech are both incompatible with a healthy open society'

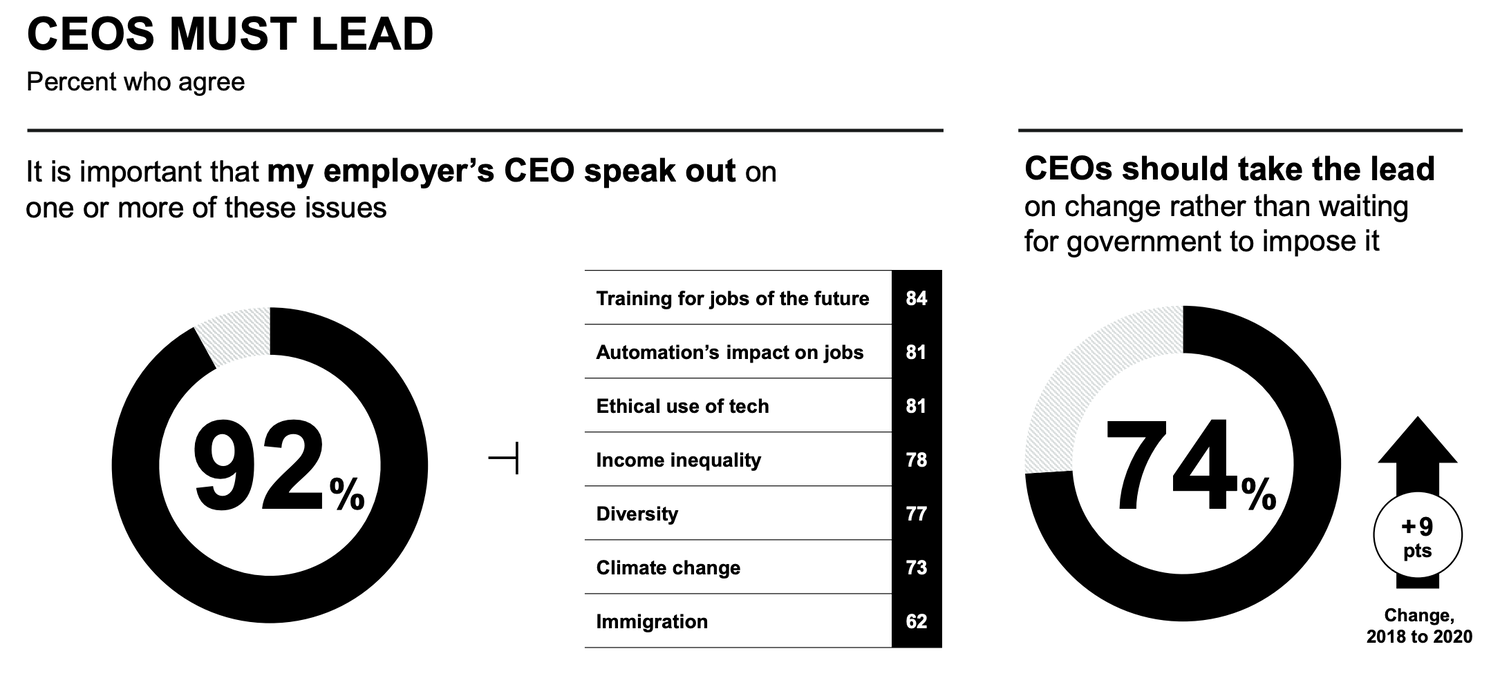

CEOs no longer lead 'just a company' but people's futures. They need to have a stance on issues to deliver TRUST. People want to trust their CEO more than their government, because they are more competent.

Why brands need to have a voice too

Interesting choice of phrase: My wallet is my vote. DAOs?

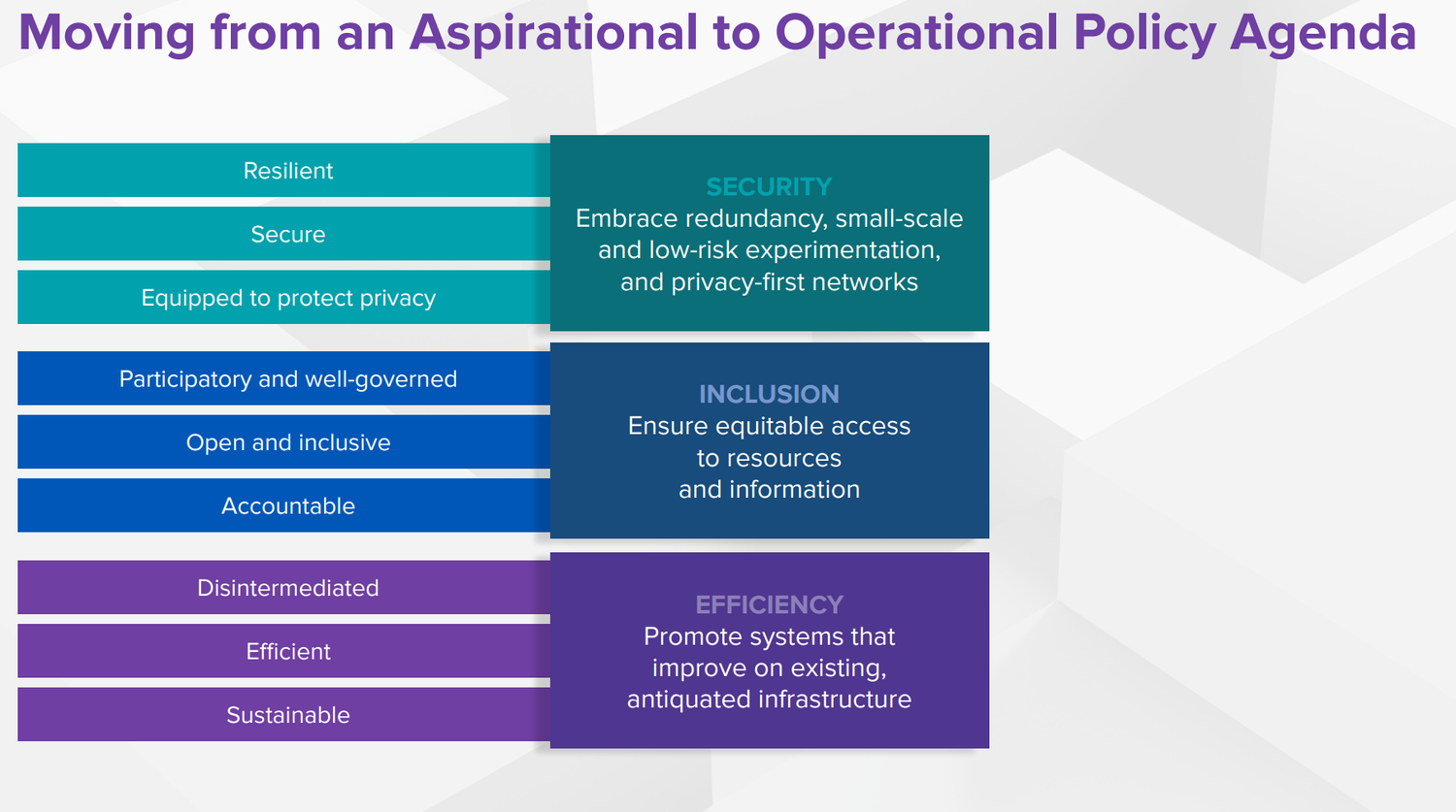

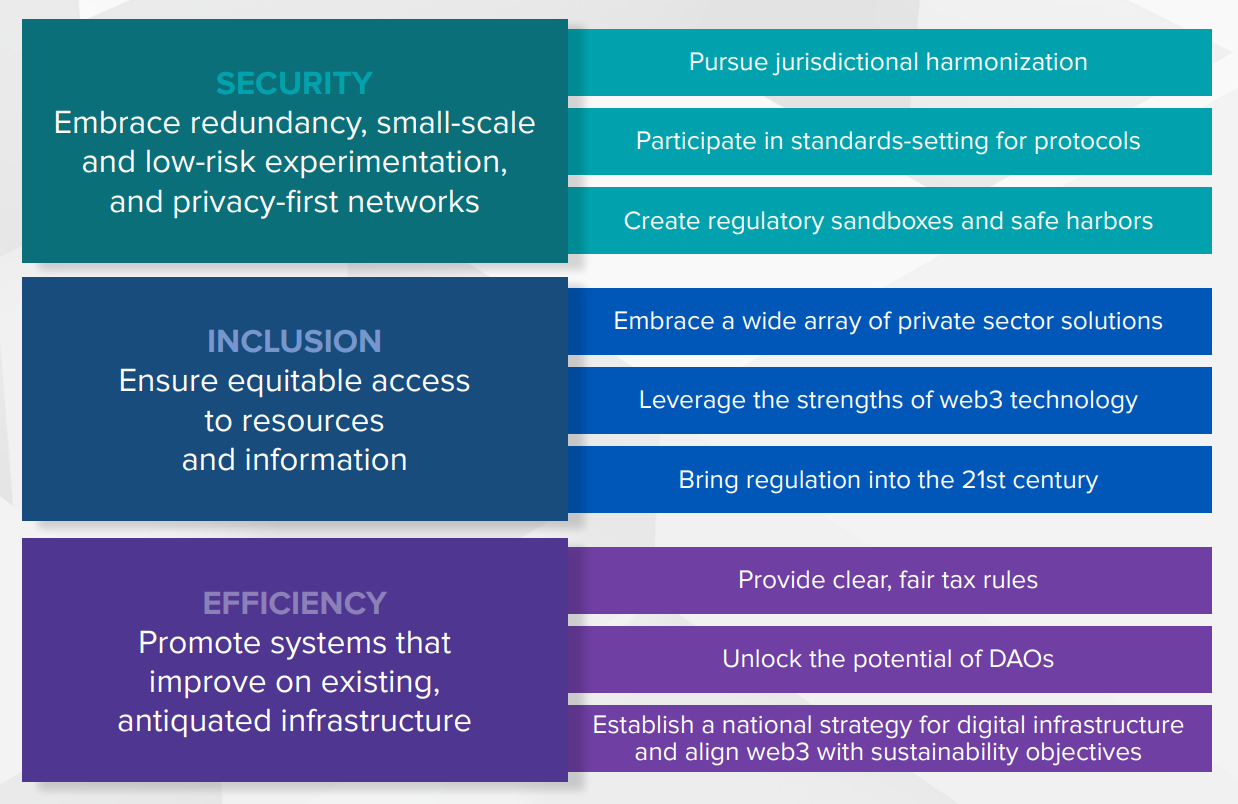

Actionable steps for security, inclusion, efficiency in web.

Currently underdeveloped in Web 3: NFT infrastructure, DAO tooling, and inter-protocol bridges

NFT Infrastructure: Marketplaces, financialization primitives, creator tools, community-oriented business models, and decentralized identity management / reputation management systems

DAO tooling: Streamlining voting

Scaling and interoperability solutions: Need for better bridges as more L1 and L2 crop up and the future is multi-chain.

Tech Analysis

MVRV: https://charts.coinmetrics.io/network-data/

When it falls below 1, BUY, when it hits 3, SELL.

GUILDS the future of PVE

Axies, Mavis, Ronin

Demand Drivers for Bitcoin

Cross-blockchain bridge protocols like Rune will unlock more peer-to-peer swaps

Ethereum bulls may protest that this is exactly what makes ETH good money and a capital asset: it’s compatible with other EVM chains and Layer 2 rollups, and already collateralizes stablecoins like Maker’s Dai. But that’s backwards looking. BTC has a 2.5x market cap lead, and a much lower rate of collateralization as working capital today, which means it’s being underleveraged, and there’s a much higher ceiling for new BTC as DeFi collateral than ETH.

I think wrapped / synthetic bitcoin tradeable on other blockchains will double again in 2022 (75% confident we’ll see 3% wrapped, at least), as more long-term bitcoin holders realize they can borrow more cheaply against their holdings in DeFi than on centralized services.

Bitcoin as the energy saver. Bitcoin mining can start using wasted excess natural gas that is being burned. "

Bitcoin miners are unique business partners, because they optimize for a single variable (lowest KWh), and serve as a mobile “energy buyer of last resort” for energy that can’t be easily transported."

What makes Bitcoin Mining suitable to use green energy now vs before?

The emergence of the “lifecycle mining” concept

The development of a new hybrid model for bitcoin mining that is partially grid-based and partially “behind the meter” mining

The slowing of ASIC development cycles.

Miners are signing up deals with nuclear power plants (which often produce excess power at night, when the grid is less demanding). (Taiwan?)

Bitcoin Miners can turn their power off without it being detrimental to their business.

This makes them perfect for “demand response” programs, which refers to agreements to curtail their demand when the grid is overtaxed and prices are high. This means that when energy is in short supply, bitcoin miners can turn themselves off and get power to the households that need it most.

In exchange for agreeing to have their power interrupted some percentage of the time, miners get rebates, so it’s economically worthwhile to opt into these programs. Even if miners aren’t participating in an explicit rebate program, surging market prices during shortages in deregulated grids like ERCOT send miners the signal to turn themselves off.

Controllable Load: Miners can tweak their consumption on-demand. They are flexible.

Wind and solar, unlike coal plants, hydro or nuclear, don’t produce energy reliably. Their intermittency means they need to be backstopped by batteries (mostly uneconomical at present), or gas-powered turbines. More controllable load however alleviates this intermittency without requiring more fossil fuels.

US-listed miners now sitting on nearly $1.5 billion in BTC at current prices, hundreds of millions in annual earnings, and significantly improved profit margins due to the China mining capacity exodus.

Forks (Bilateral Hard Forks, Strictly Expanding Hard Forks, Soft Forks, User-activated Soft Forks)

There is an essential difference between hard forks and soft forks: hard forks are opt-in, whereas soft forks allow users no "opting" at all. In order for a user to join a hard forked chain, they must personally install the software package that implements the fork rules, and the set of users that disagrees with a rule change even more strongly than they value network effects can theoretically simply stay on the old chain - and, practically speaking, such an event has already happened.

Hard forks give users a choice, they can stay on the old fork, or update to be on the new fork. (The majority will be on the new fork, but there may always be a % of people on the old fork)

Soft forks automatically update the fork for everyone, however this removes the ability of choice for users.

Soft forks are a dangerous game, and they become even more dangerous if they are contentious and miners start fighting back. Strictly expanding hard forks are also a dangerous game. Miner-activated soft forks are coercive; user-activated soft forks are less coercive, though still quite coercive because of the economic pressure, and they also have their dangers. If you really want to make a contentious change, and have decided that the high social costs of doing so are worth it, just do a clean bilateral hard fork, spend some time to add some proper replay protection, and let the market sort it out.

The Taproot upgrade makes bitcoin transactions cheaper, its adoption of “Schnorr signatures” will enhance bitcoin’s privacy defaults and fungibility by making all transaction types (simple payments, lightning channels, and multi-sig transactions) look the same, and it could unlock the next phase of development in Bitcoin’s Lightning Network

- Soft Forked on Nov 2021

- Taproot is an upgrade to Segwit and was a soft fork. A soft fork is a proposed upgrade that over time is adopted as the only blockchain.

- Combines multiple Bitcoin Improvement Proposals (BIP)

- It switched from ECDSA signatures to Schnorr signatures which makes it easier to read smart contracts.

- Schnorr is more secure, simple, and efficient.

6 issues to confront:

- Stablecoin and banking risks

- Anti-money laundering

- Tax evasion

- Investment fraud

- Exchange oversight

illicit activity accounts for just 0.34% of crypto transactions (lower than TradFi).

Most of the biggest tax compliance concerns center on information incompleteness and disorganization. That’s one exchanges should accept tax reporting responsibilities on behalf of their users.

The fat early tail often makes money at the expense of the latecomers. We should advocate for holdings-based disclosures, community reporting standards, and a Safe Harbor.

Big Crypto Players (For gov)

Coin Center: Bitcoin-centric, education and advocacy. Focused on privacy rights, code as speech, and why crypto is important and should be treated fairly.

Blockchain Association: Top trade association. Big lobbying efforts. Messari, Binance, and Ripple are members.

The Crypto Council for Innovation: Spearheaded by Paradigm. Lots of capital. More likely to be able to coordinate members until there’s a team in place

a16z Policy Team: Huge team, lots of finances, can move fast.

The Chamber of Digital Commerce:

THE CRYPTO AGENDA

- Ensure financial stability with clear stablecoin rules & careful bank integration (Fed/OCC)

- Set clear guidelines on KYC/AML reporting while preserving privacy (FinCEN)

- Clarify tax rules, and set exchange reporting standards (IRS)

- Create Safe Harbors for community governed tokens (SEC)

- Introduce DAOs as a new organizational structure (Congress)

- Harmonize exchange oversight (Create “The Web3 Commission”)

- Allow for state and city-level experimentation (Courts / Enumerated Powers)

I predict multiple new crypto banks (like Avanti) will become unicorns in 2022. https://avantibank.com/

Tax accounting software, like Taxbit, that solves the problems in accounting for Crypto are much-needed. Taxbit raised another 130 mil round.

Accounting issues for crypto users:

- No on-chain transaction history for withdrawals 90+ days in the past, making wallet identification for transfers and cost basis tracking nearly impossible.

- No transaction and trade history prior to 2020.

- No consolidated fills on orders, meaning each order can spit back 100s of transactions that each require disclosure in a Form 8949.

- No short sales tracking in current tax reporting software as these can break certain services’ trade verification engines.

SEC Mission

- Protect Investors (against information asymmetries in investing markets)

- Ensure financial markets operate fairly and efficiently

- Promote capital formation in the US

Messari Mission

- Level the information playing field, highlight risks and opportunities.

DAOs as a legal structure.

How effectively can we decentralize?

How well can we govern the open internet?

Cleanly defining DAOs as a new corporate primitive would clarify:

a) what constitutes a “common enterprise” and how to interpret the “efforts of others” in that enterprise

b) how these legal structures can streamline global tax compliance.

There are pretty obvious differences between companies and DAOs, and it starts with their fluid governance and legal structures, not their tokens.